ETH relative to AltcoinsI fee like at this current point as we see altcoin pairs bleed against ETH and BTC while putting in lower lows while Eth puts in higher highs we will not see the altseason we are hoping for until altcoin pairs hit here range lows which I can see happen end of Q3 into the start of Q4 but until then they can still rise as ETH.D continues its rally but I feel until altcoins reach its range lows being the .25 lvl on (TOTAL3-USDT)/BTC we will not see that face melting rally we are looking for.

Community ideas

NZD/USD Ready to Explode? The Smart Money Is Making a MoveBias: Bullish Bounce from Key Demand Zone

NZD/USD is testing a strong confluence zone:

Long-term ascending trendline support

Weekly demand area between 0.5890 and 0.5940

Bullish RSI divergence near oversold conditions

The triple rejection wicks signal strong demand around 0.5900, suggesting a possible reversal toward the 0.6020–0.6050 resistance area.

🧠 COT Insight:

NZD: Non-commercial traders added +669 long contracts and reduced shorts by -102 → net bullish shift

USD: Net short exposure increases; total non-commercial shorts now exceed longs by ~4000 contracts

Implication: institutions are rotating into NZD while trimming USD exposure

📊 Sentiment:

86% of retail traders are long NZD/USD → retail sentiment is heavily skewed

This could delay or limit upside as smart money often moves counter to retail positions

📅 Seasonality (July):

July has historically been a bullish month for NZD/USD across all reference windows (20Y, 15Y, 10Y, 5Y, 2Y)

Average July return consistently positive → adds conviction to bullish thesis

🗺 Outlook:

If the zone at 0.5880–0.5920 holds, price may bounce toward 0.6020–0.6050.

Break below would invalidate structure and expose 0.5850 and then 0.5780.

121Hello awesome traders! 👋

Hope you’ve managed to grab some solid pips from the markets this week. As we head into the weekend, I’m wrapping things up by dropping a few clean chart setups for you to review and reflect on.

Enjoy the weekend, recharge well — and I’ll see you sharp and ready next week for more structure-led opportunities.

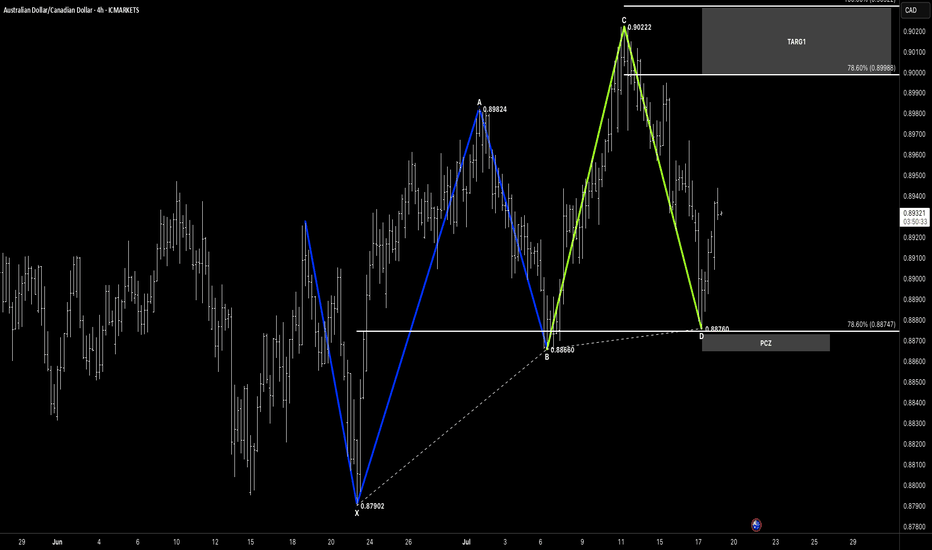

📌 Pattern Breakdown

This one's a 1-2-1 Bullish Formation — clear, clean, and already reacting:

🔹 XA: 0.87902 → 0.89824

🔹 AB retracement → 0.88660

🔹 BC extension: 0.88660 → 0.90222

🔹 CD drops into the PCZ at 0.88760 — aligning with 78.6% retracement

We’ve now seen a clear bullish reaction off the PCZ, confirming it as a valid demand zone.

🎯 Targets Now in Play

With structure holding and price climbing from the PCZ:

✅ Target 1:

• 78.6% = 0.89988

• 100% = 0.90322

🔄 Target 2 (Extension):

• 78.6% = 0.90584

• 100% = 0.91080

We’ll keep managing toward Target 1, then reassess momentum and candle structure for continuation into Target 2 next week.

🧠 Key Concepts in Play

✅ 121 Bullish pattern

✅ Reaction at fib-based PCZ

✅ Controlled impulse off demand zone

✅ Target structure mapped + invalidation clearly below PCZ

🗝 Final Thoughts

Textbook measured move off the 1-2-1 setup, with price now rotating higher from structure.

This is what we look for every week — precision, confirmation, and opportunity.

Let’s protect gains, lock partials near Target 1, and come back Monday with a clear head.

“Structure gives you the zone — reaction gives you the trade.”

Defining the $BTC top with USDT.DWhy is USDT.D so important in defining a CRYPTOCAP:BTC top?

Because, when BTC is in price discovery, there is no previous price action to determine where we might expect a reaction based on price. Therefore, all we really have are fib extensions and speculation if we solely look at past CRYPTOCAP:BTC price. Fear not, USDT.D gives us previous dominance action to evaluate when the BTC price might react. This is because USDT.D is inversely correlated with CRYPTOCAP:BTC price. Evaluating the correlation of USDT.D and CRYPTOCAP:BTC price, I found that in the current cycle, the correlation is approximately a doubling of BTC price for every -3% drop in USDT.D.

IMPORTANT: Everything below is for speculative fun. I will be watching this play out as part of an overall strategy to define a cycle top, but would never think to use it to make any decision in my life, especially if I should do a destination or hometown wedding or what brand of salve to put on my hemorrhoids.

How can we use the USDT.D/ CRYPTOCAP:BTC correlation to help pick a top? Well, we can find demand zones and calculate how far away we are from them. I don't have previous demand zones on the chart, but they have worked in the past to predict a reaction. The demand zones are somewhat subjective, so you can should verify on your own, but there are a few main zones that I see and have marked in yellow. The top of the demand zones, along with the distance from the current USDT.D in parenthesis, are 3.1% (-1%), 2.8% (-1.5%), 1.8% (-2%), and 1.3% (-2.5%). Using these drops in USDT.D, we might see some intermediate tops around $130K, $150K, and $180K.

The cycle top might be around $196K if we get to the lowest demand zone plotted on the chart. Of course, there are more demand zones below that, but I have a hard time seeing USDT.D go below 1.3%.

I added the price path as an extra bit of intrigue. It will likely not play out as I have it drawn, but why post my ideas if I'm not going to climb out on a limb and see if the prediction plays out. That would be a move of a cowardly douche. And although I am a douche, I'm not a coward.

--Da_Prof

Btcusd techinical analysis.The chart shows a BTC/USD (Bitcoin vs. US Dollar) technical analysis on the 1-hour timeframe. Here's a detailed breakdown:

---

🔍 Chart Elements & Interpretation:

1. Trend Lines:

Upper Pink Trend Line: Acts as a resistance from a previous high.

Lower Pink Trend Line: Represents a support line from the recent upward trend.

Blue Channel: Shows a rising wedge or ascending channel (often a bearish reversal pattern).

2. O.B (Order Blocks):

Upper O.B Zone (~120,000–121,000): Potential supply zone or area of resistance.

Lower O.B Zone (~117,500–118,500): Possible demand zone or support.

3. Price Projection:

A measured move of 2,585.6 points (2.18%) is marked upward from the current breakout attempt.

4. Current Price:

BTC is trading at $119,771.8, with a +0.90% increase at the time of this chart.

---

🧠 Technical Outlook:

Bullish Case:

Breakout above the upper trend line and clearing the upper O.B could lead to a continuation toward 122,000+.

If BTC respects the demand zone and bounces, the uptrend may resume.

Bearish Case:

Failure to break above resistance or rejection at

TRX/BTC - Trying to BreakoutWe have already seen the TRX/USD chart breakout (as seen in our previous post), but now the BTC pair is trying to breakout to.

On the daily chart we are trying to get above our downwards sloping red resistance line. It is possible we retest, but if this breakout continue that could push the BTC pair to above $0.000003 +. This is inline with our measured move (white line) and also where the symmetrical triangle started.

XRP Market Cap – Technical Breakdown (4H TF)XRP Market Cap – Technical Breakdown (4H TF)

Bullish momentum continues to dominate as XRP’s market cap pushes through key Fibonacci levels, maintaining its position inside a well-defined ascending channel.

Ichimoku Cloud confirms bullish sentiment — price holds above Kumo with Tenkan-Kijun crossover and strong volume support.

📈 Key Levels:

Resistance: $193.67B (Fibo 0 – local top)

Supports: $188.71B, $185.64B, $183.16B

Channel Target: $198–200B (if breakout confirmed)

🟢 Bias: Bullish

📍 Strategy: Wait for breakout + retest above $193.6B for next leg up.

🔁 Pullbacks to Fibo 0.382–0.5 zones offer high-probability long setups.

#XRP #CryptoAnalysis #TradingView #Ichimoku #Fibonacci #TechnicalAnalysis #Altcoins #BullishTrend

Gold---sell near 3355, target 3330-3320Gold market analysis:

The gold buying and selling game in the past two days is quite fierce. The daily line is washed back and forth, with a combination of one Yin and one Yang. The upper and lower shadows of the daily line are relatively long. Yesterday, the daily line closed with a standard hammer candle pattern. After breaking the strong support of 3320, the price did not continue to fall, but bottomed out at 3308 and began to rise strongly, which eventually led to the short-term selling dream being shattered again. The daily line and K showed alternating conversions. The short-term trend is vague, but the long-term trend is still buying. This wave of repairs has the participation of fundamentals and the repair of gold itself. In the big cycle, it is difficult to form a daily selling trend without breaking the position of 3281. In addition, the fundamentals all support gold. I think the possibility of a deep fall in gold in the near future is very small. We are just a follower. In the short term, we focus on the intraday trend to operate. Yesterday, the daily line had a tail, and the possibility of continuing to fall today is small. Let's look at the repair rebound in the Asian session first. The first suppression position for buying rebound is around 3357. This position is also a form suppression and an indicator suppression. The other suppressions are around 3366 and 3377. Note that gold is not unilateral. When encountering great pressure, we must also consider selling opportunities. Today, I think it will rebound first and then fall back.

Support 3327 and 3320, strong support 3308, pressure 3344.3357.3366.3377, and the strength and weakness dividing line of the market is 3340.

Fundamental analysis:

There are not many fundamentals this week. The data released yesterday still suppressed gold as a whole, but the gold tail market still bottomed out and rebounded.

Operation suggestions:

Gold---sell near 3355, target 3330-3320

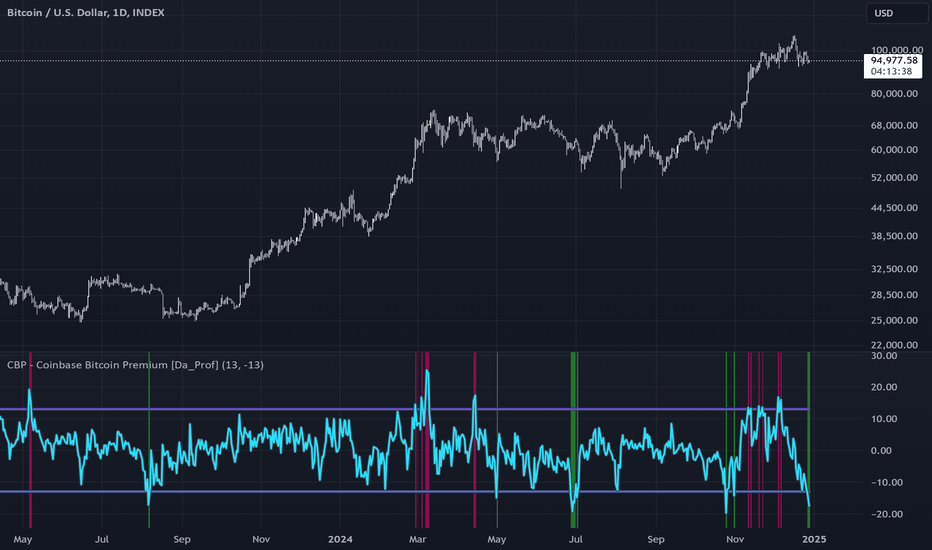

The $BTC Swing Indicator Signals Low RiskHappy New Year! The indicators that make up the Bitcoin Swing Trade Indicator (BSTI) are bottoming in aggregate. I've been searching for nice daily swing trade indicators and have been swapping them out in the BSTI. Therefore, the BSTI has gone through changes, but it is almost ready for prime time. I'm thinking of changing out one more indicator. The solid ones I'm keeping are the SOPR momentum, money flow, aggregate funding rate (AFR), MACD, RSI, hash rate capitulation, Bollinger band trend, Coinbase premium, plus directional movement, and the transaction fee spike indicators. Besides the AFR, which is neutral, the indicators are signaling generally low risk.

--Da_Prof

Global liquidity downtrend cometh!During this current BTC cycle, major uptrends in global liquidity have corresponded to major uptrends in the market 72ish days later. The last major uptrend in liquidity is about to run its course, pause, and then downtrend. If this relationship holds, we are at or near at least a pause in the local up trend. I have my popcorn ready to see if this plays out.

Note: The global liquidity prediction pauses until December 11th and then downtrends, so if we see floating higher prices until that point and then a pause, the relationship would still be valid.

Second Note: I will publish the BGL (Bitcoin Global Liquidity) indicator very shortly. Please test it out and DM me if you see any issues or have suggestions.

--Da_Prof

Coinbase Premium Signals OversoldThe Coinbase Premium (CBP) is currently signaling "oversold". This is an indicator which identifies extremes in the price of CRYPTOCAP:BTC on Coinbase in relation to the average of the Binance and Bybit CRYPTOCAP:BTC price. The CBP has done a pretty good job over the last few years of identifying levels of high and low risk for the price of $BTC.

OFFICIAL TRUMP Main trend. 16 05 2025Logarithm. Time frame 3 days. After a super pump and a drive of "stupid money", a descending channel was formed on a natural dump. The price came out of it. Now a triangle is forming. The price is clamped. The reversal zones and percentages to the key support/resistance levels are shown extremely accurately according to TA.

If there is no aggressive exit in the medium term, then there will be consolidation and, as a consequence, the formation of a horizontal channel "sholtai / chattai", its key zones are shown.

Now, this "cryptocurrency" is now on 16 05 2025 in 41st place by capitalization.

Reductions from the price highs are about -90%.

From the liquid zone about -84%.

These are not the minimum values of the decline of such hype cryptocurrencies. Just take this into account in your money management. For clarity, the level zones and the % of potential decline if the trend breaks again are shown on the chart (pull the chart down).

Even with such a decline, the price is now at a huge profit. I am not speaking for the creators of the cryptocurrency, but for the first speculators and "investors" who may not have sold everything on the hype.

For the creators of the cryptocurrency, perhaps these are manipulators close to the Trump family, for them, any sale is super profit. But in order to sell, you need to maintain liquidity, and from time to time make interest in speculation and asset retention by investors, that is, do pumps and hype. Use this, and do not be greedy...

Levels and zones, pump/dump, which the price will "feel" are shown in advance. Click "play" on the chart and move the chart up. With a high degree of probability, the hype and pumping of the price of this cryptocurrency will be repeated, given the hype and the long term of the political figure whose name this cryptocurrency bears. Now it is a Trump dump, in the future it will become a Trump pump for some time.

Do not forget to sell on the next hype. If you understand that you are very greedy, and the news background affects you, then sell in parts, or use stop losses to protect profits.

There is no need to guess the minimums and maximums. It is important to know these zones, and have an acceptable average price, from the position of the trend, and its potential. It is regulated by the distributed entry volume (in advance) at potential reversal zones.

Some top triggers are getting heatedThe NUPL (Net Unrealized Profit/Loss), RP (Realized Price), and to a lesser extent, the CVDD (Coin Value Days Destroyed) are getting close to triggering. The last time a few top indicators on the BTI got close to triggering, we had a pullback. I think we see a continued rally near-term, but then a pull-back to cool off the indicators before they fully trigger...but what do I know?

Notice that the risk has not yet reached 7, where the previous pull back occurred, but it is very close. Let's see if we are in a 2017 or a 2020-type cycle.

Note: Extrapolating to a CRYPTOCAP:BTC cycle top is very difficult, but I think the BTI is the best shot I can come up with to do that. Using the risk value and the triggers of multiple top indicators should allow us to get close.

BTC Next Move within 11-15 DaysBTC will hit $62,528.74 Within 11-15 Days

The historical trend suggests that once Bitcoin (BTC) surpasses the $50,000 threshold, it typically enters a bullish phase, experiencing significant gains. This observation is based on past market behavior, where crossing this key price point has often led to increased investor confidence and subsequent price surges.