Markets Converging MVIS market changing potentialMicrovision is weeks away from hitting an intense inflection point.

Pending news for SBMC (decision date August 29th )

Microvision is partnered with NVDA for their driving lidar and software -- and have a plug and play system better than any competitor. (an update was made to MVIS website while

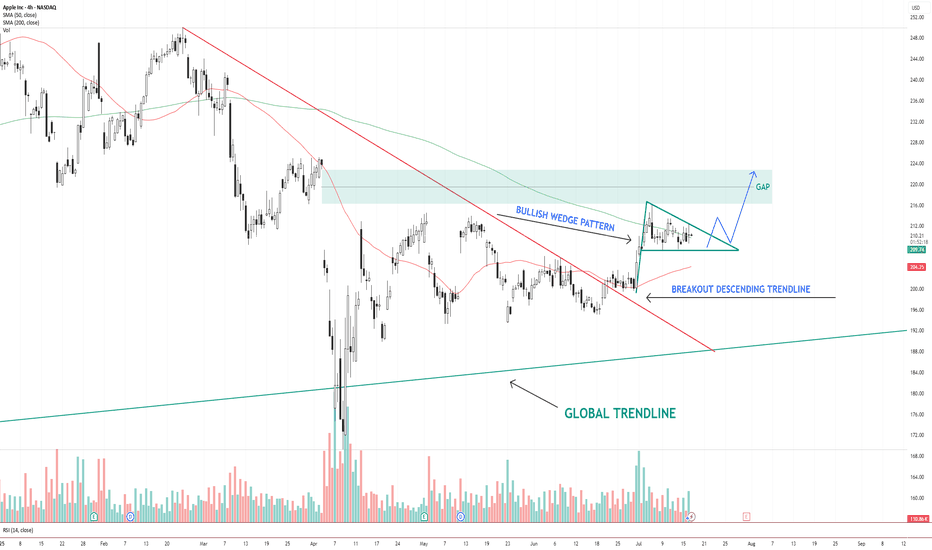

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting

QS Breakout Setting Up — Entries Triggered, Waiting for ConfirmSeed System entries are printing on QS with trailing profit zones holding firm.

MACD crossovers confirming the move. Watching RSI cooling just under breakout resistance at $11.35.

A push through $11.50 with volume and I’m adding — slowly.

Support at $10.03, cut fast if price shows weakness.

Let

I'm just going to keep putting the hammer down - Long at 3.88I've done two other ideas for ASM in the last 3-1/2 months, so I'm not gonna rehash all those details here. If you are new to me or to my ideas for this ticker, just look at those. In them, I make a fairly compelling argument for short term trading this name. I'll sum it up quickly here - it's be

Palantir Is Up 600%+ Since August. What Do Its Charts Say?National-security software firm Palantir Technologies NASDAQ:PLTR hit a new all-time high this week and has gained more than 600% since hitting a 52-week low last August. What does technical and fundamental analysis say could happen next?

Let's look:

Palantir's Fundamental Analysis

PLTR has b

Double Top in MELI – Potential Reversal Inside a Channel🧠 Double Top in MELI – Potential Reversal Inside a Channel

Ticker : MercadoLibre, Inc. (MELI)

Timeframe : 1D (Daily Chart)

Pattern : Double Top

Bias : Bearish Reversal within a Bullish Channel

Technical Breakdown

We're spotting a clean Double Top at the upper boundary of a long-term asc

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activePre-market gainersPre-market losersPre-market most activePre-market gapAfter-hours gainersAfter-hours losersAfter-hours most activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksPink sheetOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Jul 17

TCBITexas Capital Bancshares, Inc.

Actual

1.58

USD

Estimate

1.29

USD

Jul 17

ELVElevance Health, Inc.

Actual

8.84

USD

Estimate

8.91

USD

Jul 17

PEPPepsiCo, Inc.

Actual

2.12

USD

Estimate

2.03

USD

Jul 17

CFGCitizens Financial Group, Inc.

Actual

0.92

USD

Estimate

0.88

USD

Jul 17

IIINInsteel Industries, Inc.

Actual

0.78

USD

Estimate

0.69

USD

Jul 17

FITBFifth Third Bancorp

Actual

0.88

USD

Estimate

0.87

USD

Jul 17

MMCMarsh & McLennan Companies, Inc.

Actual

2.72

USD

Estimate

2.67

USD

Jul 17

SNASnap-On Incorporated

Actual

4.72

USD

Estimate

4.63

USD

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Technology Services | ||||||||

| Electronic Technology | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Retail Trade | ||||||||

| Consumer Non-Durables | ||||||||

| Producer Manufacturing | ||||||||

| Energy Minerals | ||||||||

| Consumer Services | ||||||||

| Consumer Durables |